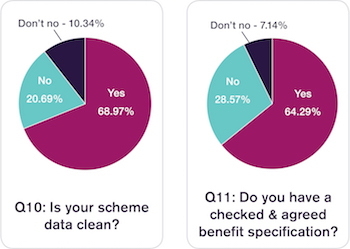

I must admit that I found a few of the results of our recent de-risking survey to be somewhat surprising. I’m worried pension trustees are wearing rose-tinted spectacles if 78% of them think their scheme data is clean. From my experience across the industry, this is (unfortunately) highly unlikely!

What is clean data?!

I fear pension scheme trustees are now used to seeing data scores of around 90 – 100% which are simply recording the presence of 11 ‘common data’ items like name, address and date of birth. When it comes to more complex pension scheme data, like that needed for an insurer to take over paying benefits on a pension buyout or annuity purchase, we know that there are lots of hidden nasties.

The pension scheme administrator is usually able to sort out any problems on an individual level when they put a member’s benefits into payment. They wouldn’t, however, be able to provide information in bulk quickly if it isn’t stored in the required format. This means a buy-out opportunity could be missed.

This is why the Pensions Regulator (tPR) has decided pension schemes must also report on the state of their ‘conditional data’ on the next Scheme Return. It is important pension trustees really do start to get to grips with this issue.

Those pesky gremlins

I was also quite surprised, but also pleased, to discover as many as 64% of pension schemes had a checked and agreed benefit specification. This would suggest automated calculations are now more prevalent.

On reflection, that perhaps shouldn’t be so surprising. Most schemes are now closed and the key benefit specifications needed now are for the retirement of deferred members and annual pension increases. Nevertheless, we have found a few gremlins almost always come to light when pension trustees decide to move scheme administrator. There often seem to be errors in the previous scheme administrator’s interpretation of the rules.

Similar gremlins are usually found as part of the due diligence work done prior to buy in or buy out, or running ‘member options’ liability exercises So, even if you are not planning to change administrator or look to an insured pension solution in the immediate future, it makes sense to have a thorough review of your benefit specifications. Making sure the administrator, actuary and scheme lawyer are all on the same page with the scheme benefits could prove invaluable later down the line.

‘ PSGS & 20-20 Trustees merge to form Vidett ’

Punter Southall Governance Services (PSGS) & 20-20 Trustees (20-20) have today announced they...

‘ Don’t be surprised that your gilt funds are being treated like an emerging market ’

You may have seen or heard about the article in the Financial Times about how Insight...